Bank on Loop to Save Money

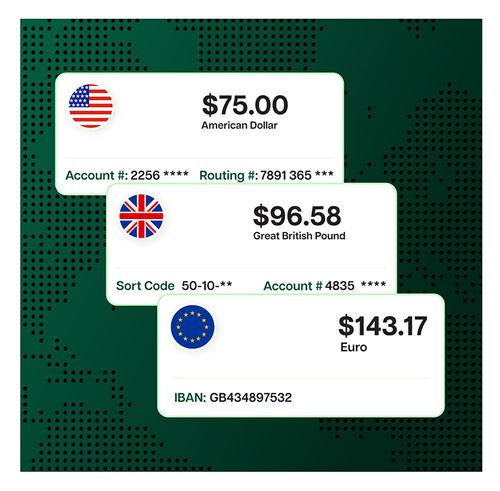

Canada’s leading business banking platform offers global banking details, multi-currency corporate credit cards, international payments, and more.

Endorsed by top international brands

Banking designed to help your business grow globally

Conserve 5% of your

revenue

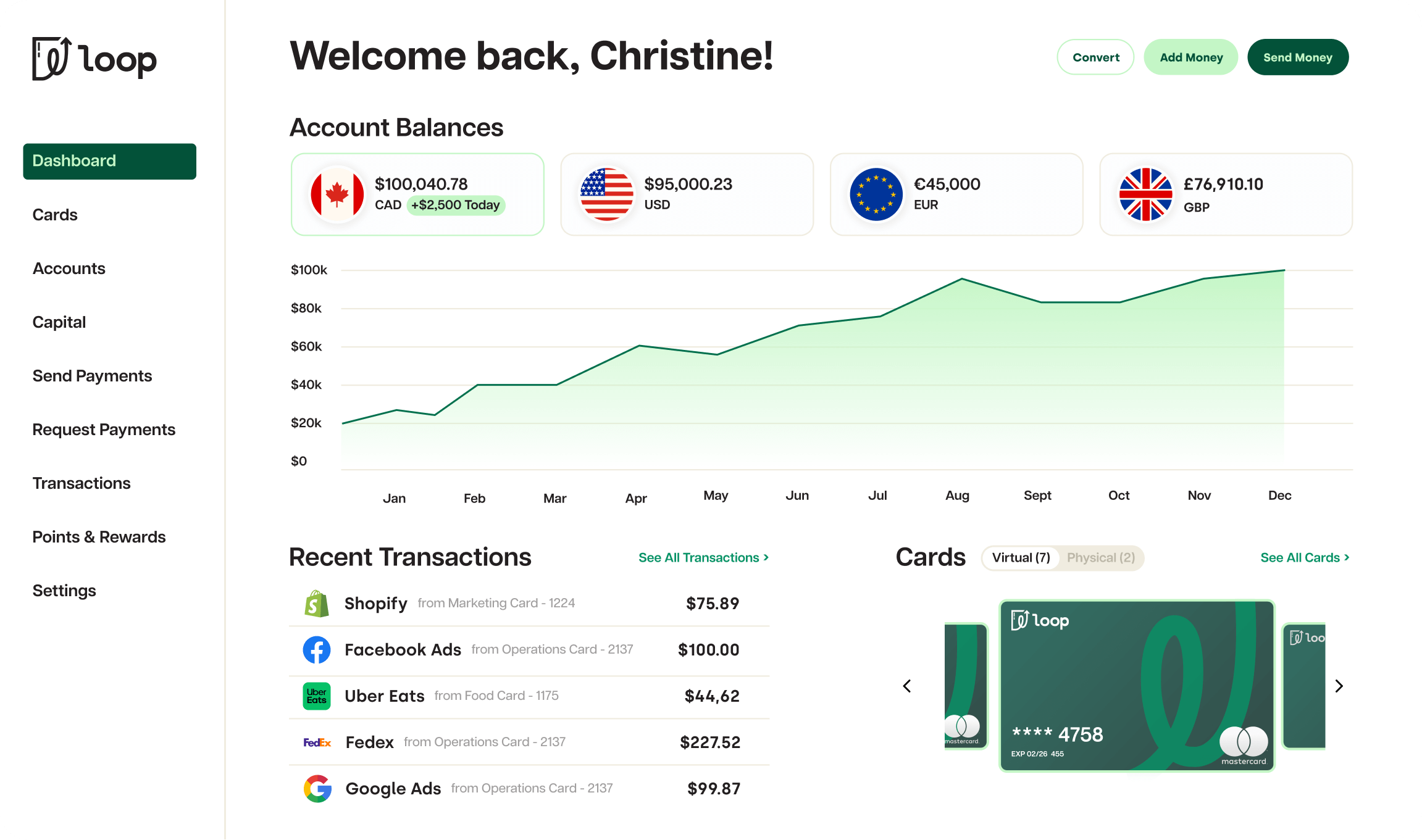

Loop enables you to cut down 2-6% in FX fees on every international payment.

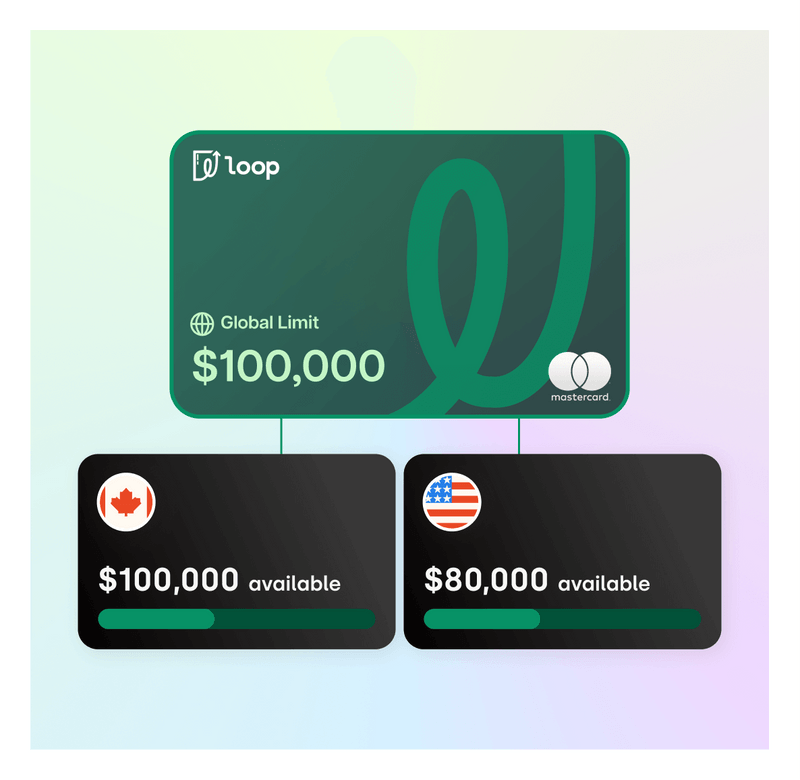

Access scalable corporate credit

Accelerate growth with credit limits tailored to your business performance.

Accept foreign currencies

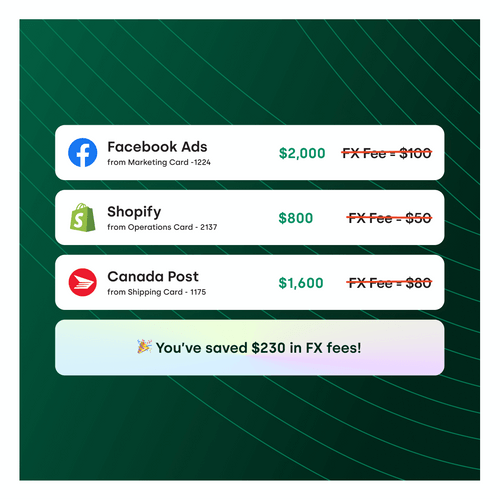

Open local accounts for free local transactions in the US, EU, and UK.

Turn Banking into Your Competitive Edge

Grow globally with annual savings of $40k+

With Loop, eradicate FX and bank fees using multi-currency corporate credit cards and local accounts. Benefit from industry-leading conversion rates and robust financial management solutions, all crafted to accelerate your growth.

Utilize Loop for FX-free spending in various currencies.

Canada’s inaugural no-fee multi-currency credit card that saves every time you make a purchase.

End double conversions permanently.

Establish local accounts in USD, GBP, and EURO for seamless local payments and receipts.

Accelerate growth with access to up to $1 million in capital.

Access credit that scales with your business, offering up to 55 days of interest-free spending.

The reliable partner that saves you time and money in banking.

Utilize robust global banking tools tailored to fuel your growth and streamline financial operations.

12hours | $40k |

| Avg. saved / wk | Avg. saved / yr |

1000+ | $250M |

| Businesses trust Loop | Transacted on our platform |

Loop provides multi-currency cards that aren’t restricted to spending in a single currency. With your Loop card, you can make purchases in CAD, USD, EUR, and GBP without facing FX fees. Your outstanding balances are presented per currency and can be cleared in the respective currencies. This feature eliminates the need for unnecessary currency conversions since you can repay in the currency you used for spending.

If you only have a CAD bank account, you can still make purchases in foreign currencies without the card automatically converting them to CAD. At the end of your billing period, you can choose to convert funds from your CAD account into the currencies you owe. Loop provides global FX conversion with just a 0.5% mark-up, which is substantially lower than the typical 3-4% markup charged by banks. It’s also more favorable than online FX service providers like Transferwise and OFX.

Opening a multi-currency account with Loop is entirely free. Moreover, the signup process is entirely online, allowing you to open U.S., European, and U.K. Pound accounts right from your home (no need to visit a bank branch). These accounts include local account and routing numbers that can be used for receiving, sending, and storing funds.

There are no predefined limits on the amount of funds you can receive into your multi-currency accounts.

Certainly, you can currently make payments through Loop without any charges. However, please note that there may be a nominal wire transfer fee introduced in the future to cover the processing costs associated with wires. As of now, all services are provided at no cost to you.

Transfers initiated via Loop will typically reach your payee’s bank account within 1 business day.

There are no annual fees associated with Loop. Currently, we provide a complimentary monthly plan called Loop Basic. For additional features, you can opt for our Loop Plus plan priced at $49 CAD per month or the Loop Power plan priced at $199 CAD per month.